Taxes for Artists

A4A Webinar: Taxes for Artists w/Amy Smith

Assets for Artist have provided another workshops that hit a home run for artist's to

WOW! (Woman Of Wisdom) Amy Smith shares her knowledge and expertise to educate artist. So thank Amy for your time your dedication.

I just want to highlight a few points from the webinar that jumped out to me as simple tasks, they will benefit you in the long run. The key is to be consistent and to document.

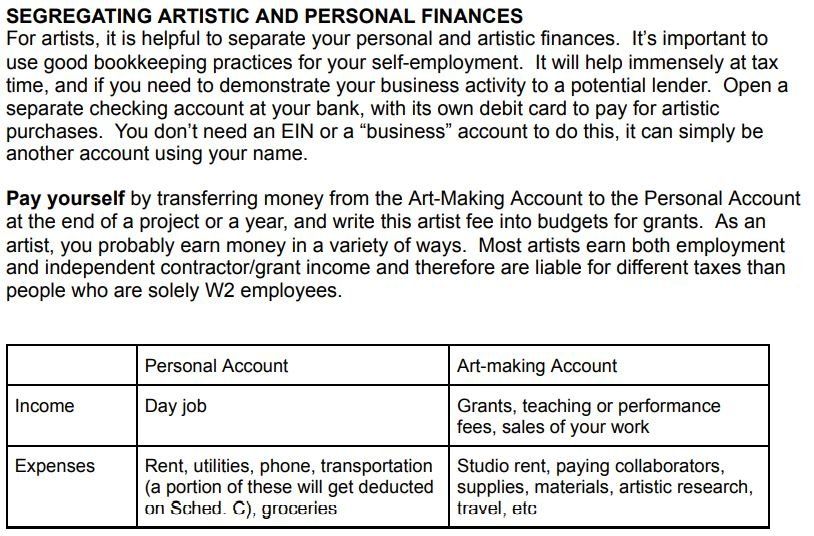

1. Tracking expenses.

a. Having some form of how you keep record of your receipts.

b. Separate bank account for your business.

2. Don’t be afraid to write off expenses. What helps you create? Do you go to different place to be inspired? Do you rent out a space? Do you go to a museum? Go to a workshop or conference? For example, as a performing artist I will write off any studio rentals, travel, gas, independent contracts, software, concerts, music, sheet music, equipment, marketing campaigns and memberships. Just to name a few.

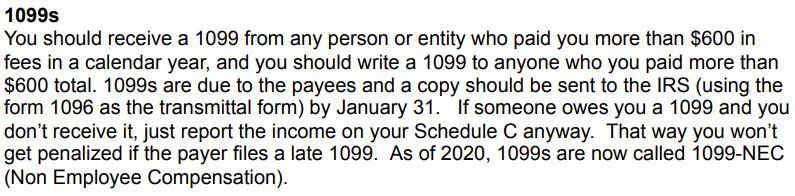

3. 1099s and Schedule C. A couple of forms we should familiarize ourselves with when it comes to filing as artists.

Amy reassured that “THE IRS IS NOT OUT TO GET YOU.” She goes on saying that “Many artists underreport their expenses for fear of triggering an audit, but the IRS actually wants you to deduct your expenses accurately. An audit can happen any time, but your chances of being audited art tiny – less than 1%.”

I highly recommend going to amyelainesmith.com to get this free document and more, here’s the direct link to the document shared in this article. Deadline to file your taxes have extended to MONDAY, MAY 17, 2021.